Erm, does the White House understand the Fed Chair does not set rates?

It’s nearly May 2025, and the White House is demanding that Federal Reserve Chair Jerome Powell “cut rates.” It’s confusingly funny because the Chair can’t actually do that. Let me explain why.

It’s no secret that the top public servant we employ in the executive branch, DJ Trump, is profoundly clueless when it comes to basic economics.

As I’ve pointed out before, the White House does not seem to grasp that macroeconomic interconnections actually exist. For example, there’s no recognition that one way to lower trade deficits is to reduce US fiscal deficits (It’s right in the balance of payments formula!)

Anyhow, we’re now watching Trump quadruple? quintuple? octuple? down on incompetence, while his signature economic strategies juice inflation, possibly stagflation.

Instead of pivoting: halting his Tariffs über Alles strategy, reversing the systematic shredding of the rule of law (remember: if contracts don’t apply to the government, they apply to no one), or ending the randomized mass firings of the US civil service. Trump is now demanding that the Fed Chair cut rates or be fired.

I guess the theory is: if you love politicized currencies like the Russian ruble or Turkish lira … you’re going to love a Trumpified US dollar? So long price stability and thanks for all the fish?

Setting aside the fact that a stable currency, non-politicized monetary policy, and ironclad contract law have served the US well for nearly a century, the strangest thing about this latest demand is what it reveals:

Trump has a fundamental illiteracy, not just about the Fed Chair’s role, but also about how interest rates actually work!

Let’s me explain.

How interest rates are set in the United States

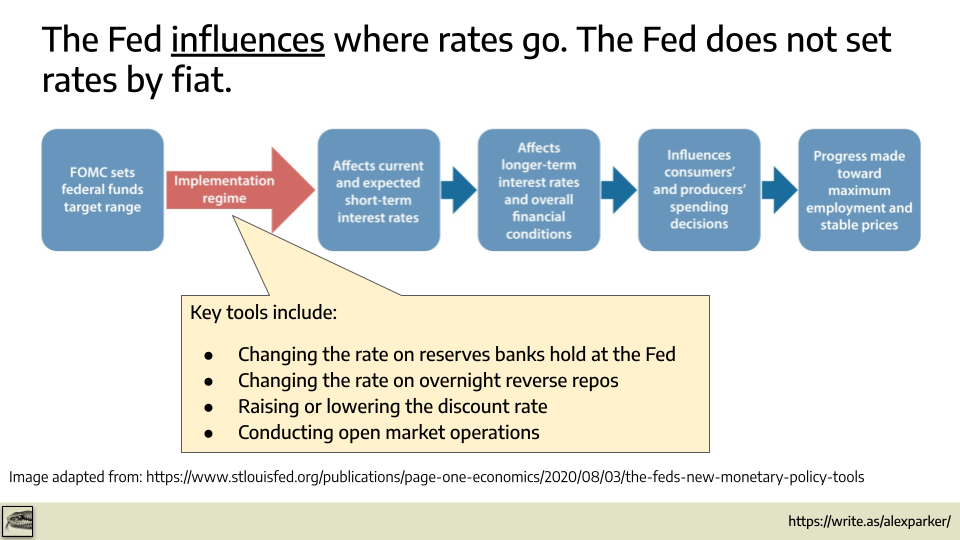

Neither the Fed Chair nor the Federal Reserve, strictly speaking, sets interest rates. Seriously!

All the Fed does is influence where rates go and the market does the rest.

Specifically, the Federal Open Market Committee (FOMC) votes on a target range for the federal funds rate, or where it wants the overnight rate at which banks lend reserves to one another to end up. This august body has twelve votes, including the Chair of the Federal Reserve. Changes require a simple majority.

Once this range is agreed upon, the Fed uses a few market-based tools to influence the direction of short-term rates toward the target. These include:

- Changing the rate on reserves held at the Fed

Banks can save money at the Fed. Raising the interest paid on reserves encourages banks to hold onto funds, reducing lending and pushing short-term rates higher. Lowering it has the opposite effect—it makes lending more attractive and lowers rates. - Changing the rate on overnight reverse repos

In a reverse repo, the Fed borrows cash from financial institutions overnight, offering Treasuries as collateral. Raising the rate it pays to borrow that cash makes parking money with the Fed more attractive, which puts upward pressure on short-term rates. Lowering the rate pushes those rates down. - Adjusting the discount rate

This is the rate banks pay to borrow directly from the Fed at the discount window. Raising the discount rate increases the cost of short-term funding and signals tighter policy. Lowering it reduces that cost and typically supports lower market rates. (This is rarely used.) - Conducting open market operations

Buying Treasuries injects reserves into the banking system, which increases liquidity and lowers short-term interest rates. Selling Treasuries drains reserves from the system, raising short-term rates.

Now that you know how the Fed influences rates, it’s easy to see why demanding that Chair Powell “cut rates” is a dead giveaway that the White House doesn’t know what it’s doing.

Most obviously, because the Chair is just one of twelve votes, he cannot move rates unilaterally. It’s like demanding the foreman of a jury to hand down a guilty verdict without consulting the rest of the jury.

More importantly (and this seems entirely lost on the current administration) the Fed relies on market-based tools. That means market participants, not Powell, ultimately determine where rates settle. If the market loses faith in the Fed as a fair dealer—or worse, in the United States altogether—the Fed becomes powerless.

That’s why unhinged threats from the executive branch and Republicans matter. It’s not just illegal, it’s ignorant. Powell (or any future oppa, oppa Weimar-style! chair) can’t do what’s being demanded. And worse, the threats corrode institutional credibility, weakening the very confidence that allows the Fed to function at all.

That said, what’s worth understanding what a Fed rate cut might actually do in this already stagflationary environment, but that’s a blog post for a different day.