The cringy billionaire love for Curtis Yarvin

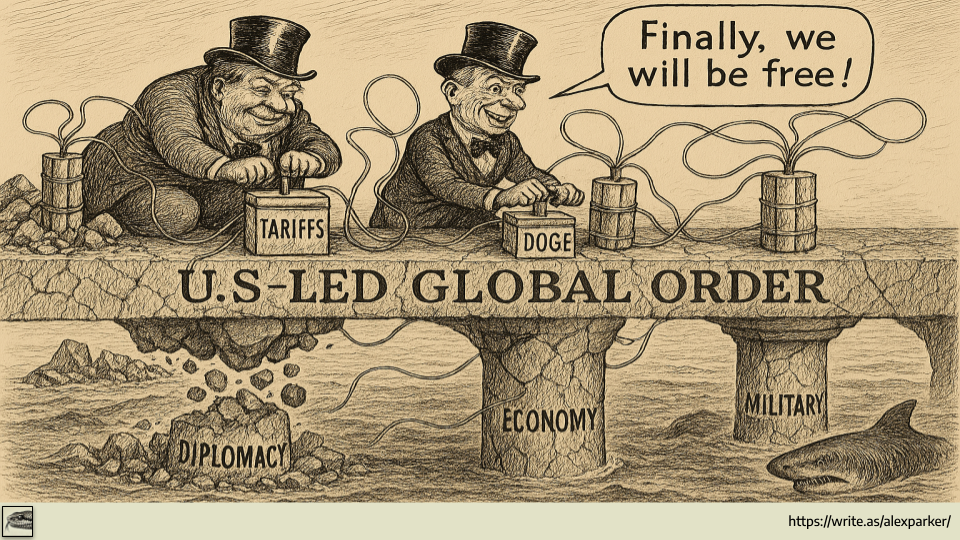

Billionaires who built their fortunes under the US-led global order now think dismantling it would be better. Oddly naive for guys who claim to know how the world works

You don't want the truth because deep down in places you don't talk about at parties, you want me on that wall, you need me on that wall. We use words like honor, code, loyalty. We use these words as the backbone of a life spent defending something. You use them as a punchline.

Lt. Col Jessup, A Few Good Men

What is astonishing is how many ostensibly clever, wealthy toffs have swallowed Curtis Yarvin’s ideas hook, line, and sinker. I suppose it’s a perfect reminder that having cents doesn’t guarantee sense.

The core notion that we can simply swap out the US-led global order for micro-sovereignties—something resembling pre-Garibaldi Italy, pre-Bismarck Germany, or the Greek city-states before they tore each other apart—is as historically illiterate as it is impractical. Add in the belief that these billionaires would somehow retain their wealth in the ensuing chaos? Pure delusion.

These Disciples of Yarvin fail to realize that their wealth depends on the US-led economic system they want to discard. The US-led post-war system, or what Paine describes as the US ‘maritime empire, rests on three pillars:

- The Money (US Dollar and the independent US FRB),

- The Iron Fist (US Military & Alliances), and

- The Velvet Glove (Global institutions, US Diplomacy, Cultural exports).

(n.b., classically, this has also been described as DIME. There’s the soft power chord, DEI—Diplomatic, Economic, and Information—and the hard power component M—military. For nearly a hundred years, the US attracted allies with DEI and challenged opposing forces with the combined might of its military and allies).

The system has been a pretty good bargain—join us! follow our rules! get rich! Despite issues like wealth inequality, it has been astonishingly effective. Over the past 80 years, this system hasn’t just generated immense wealth for nations but for individuals across the globe. Billions have escaped grinding poverty because of it, and a select few have become unimaginably rich because of it.

Pushing to discard what’s not broken is akin to deprecating a perfectly functional system just because it’s accumulated some technical debt. For what it’s worth, it was at that moment I knew Mr. Yarvin was a charlatan. I hear echoes of every single overconfident developer who’s ever said “C’mon I can rewrite it over the weekend!”

But let’s game it out. Let’s run the gedankenexperiment and think about what happens in a post-US world.

Marge, it’s Chinatown!

Without the US security backstop, small and medium-sized countries in East Asia and Australasia would be left to the mercy of Chinese coercion. Musk and company seem to believe that if the US-led order collapses, China will simply let them glide by unscathed. Really? Who, exactly, is going to stop the Chinese Communist Party from interfering—and eventually crushing them—once they outlive their usefulness? Just ask Jack Ma, the Bitcoin miners, or China’s ed-tech, mobile gaming, and real estate industries—the moment they grew large enough to challenge state power, they were dismantled. Even movements that posed no real threat to the CCP—the Uyghurs, the Tibetans, Falun Gong—have been ruthlessly suppressed.

This dynamic wouldn’t be limited to East Asia. Across the globe, larger powers would dominate smaller ones. Consider the Middle East and Southeast Asia—regions where Israel and the Gulf states, both major backers of the tech-billionaire class, punch well above their weight. But they do so only because of the US security umbrella. Remove that, and the balance shifts dramatically.

Türkiye Talk

The most likely candidate for regional dominance? Turkey. With the region’s largest military, a rapidly growing indigenous defense industry, the most developed industrial base, and strategic geography, Turkey is uniquely positioned to fill the vacuum.

This wouldn’t just shift regional power—it would restructure the flow of Gulf wealth. Under the US security umbrella, Gulf sovereign wealth funds (SWFs) freely funneled their petrodollars into Silicon Valley. But if the Gulf states, stripped of US protection, seek Turkish security guarantees, those guarantees won’t come free.

Ankara would almost certainly extract its price through capital redirection into Turkish industries. It’s likely that the Gulf’s financial elite would need to shift some of the funding for AI startups and space ventures into Turkish defense projects, infrastructure, and industrial expansion instead.

Europa Takes the Bull by the Horns

In Europe, it’s less about the US Security Guarantees and more about those velvety soft US-led institutions and diplomatic influence.

I know everyone has been chittering the impending collapse of Europe without NATO and the US. But then again, many of the people making these claims are the same sort that were convinced that the PIGS (Portugal, Italy, Greece, Spain) were going to crash out of the EU and the entire European project would be in tatters. The Europeans will find a way to guarantee their security with, or without the US. (Strangely, the sheer officiousness of the Trump administration seems to be pushing the Europeans closer together making a defense pact more likely).

In any case, I’ve noticed that Europeans often muddle their way to a solution in major crises. The muddle seems to be a byproduct of their proportional representation systems. While it is slow, it has the side effect of enforcing coalition-building and moderation on everyone. Look at what’s happened to the so-called “far right”—Meloni in Italy, Wilders in the Netherlands, the Sweden Democrats—once they were confronted with the realities of building governing coalitions, they had to jettison their least popular and most extreme ideas.

This skill in mediating between “Fools” to the left of me and “Jokers” to the right is massively useful in international governance, where managing the competing demands of various countries and organizations is essential. Moreover, lower-volatility, technocratic governance in Europe means consistency and stability over longer timeframes. That steady hand—perhaps found only in China (wrapped, noose-like, around one’s throat, naturally)—is great for business and ideal for establishing international rules of commerce.

What this means is that as the US-led rules-based system falls away, it’s Europe—not the billionaire class (via the US)—that would set the terms of global commerce. An unrestrained Europe would be emboldened to impose its citizen-centric rules on privacy rights and disinformation, directly challenging the My Speech Absolutists like Musk, Thiel, and Zuckerberg. Given the size of the European economy, it would also have the institutional muscle to enforce financial stability regulations like Basel III and Solvency III on the financial sector. A defanged US wouldn’t mean a freer world for billionaires—it would mean a world where the EU, not Silicon Valley, dictates the rules of global tech and finance.

No node, no exit

The weirdest part of all this is that most of the billionaires enthralled by Yarvin are the same ones who built their fortunes using Metcalfe’s Law and network effects. They understand that the value of a network grows exponentially with its connections—yet they seem eager to sever the most important node in the global system.

From a power-law perspective, the US isn’t just a node—it’s the most central node in the scale free network, the hub that stabilizes global trade, capital flows, and innovation. It’s the platform layer, providing the security, liquidity, and institutional trust that lets markets function. Kill the node, and the network doesn’t neatly reconfigure—it fragments. Instead of a seamless, open system where capital and ideas flow freely, you get a patchwork of competing spheres, each imposing its own constraints (some of which I tried to prognosticate above).

The billionaire class imagines they can navigate a post-US world as effortlessly as they moved between Sand Hill Road, Dubai, and Singapore—but power-law effects don’t work in reverse. A multipolar world doesn’t mean more freedom; it means more chokepoints, more transactional politics, and fewer places where wealth can exist above the fray.

They wanted exit, but in a world where the US no longer holds the system together, they might find, that hell is other countries.