What a US Treasury Default Might Look Like

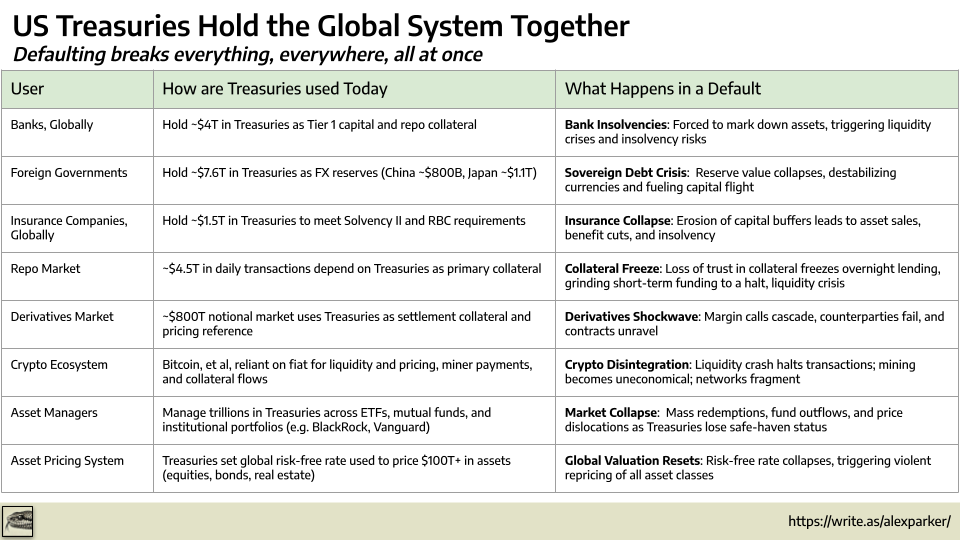

Let’s game out what might happen in a scenario where the US defaults on treasuries.

With Trump’s ongoing shenanigans in the US government—especially at the Treasury—it’s worth considering the fallout if the US defaults on its bonds.

Unlike past years, when debt ceiling fights were mostly political theater, this time the Dotards of DOGE have been caught tampering with multiple Treasury systems. Add an incompetent purge of federal workers—including key positions at Treasury—and the risk of an accidental default from sheer incompetence has never been higher.

And since global markets now run on automated systems—trading, collateral management, and reserves—even the hint of default could trigger an algorithmic meltdown. Assets liquidate, credit tightens, and Treasuries get dumped en masse.

Oh, when I write global, I mean global.

For nearly a century, US Treasuries have been the foundation of global finance. Force a default, and the entire system collapses. Stocks, bonds, banks, pensions, insurance companies—even crypto—all go with it.

Let’s take a look.

Insolvencies, everywhere all at once

Banking is a simple business. You borrow from depositors and lend most of it out—that’s how banks create money. To stay solvent, banks keep a small reserve to absorb losses, ensure liquidity, and maintain confidence.

To prevent instability, Basel regulations—redesigned after 2008 to safeguard the financial system—require banks to hold high-quality liquid assets (HQLA) in their reserves. US Treasuries serve as Tier 1 capital, the safest and most liquid reserves a bank can hold. They are considered equivalent to cash because they are viewed as riskless assets, based on the belief that the US will never default on its debt.

However, if the US defaults, banks worldwide would be forced to:

- Write down the value of their US Treasury holdings.

- Mark down reserves, weakening their balance sheets.

- Dump assets to stay solvent.

This isn’t just about banks taking losses—this is about the collapse of the global pricing mechanism.

Because all assets are priced in relation to the risk-free rate. The entire structure of asset pricing, credit markets, and corporate valuations depends on the assumption that US Treasuries define the global risk-free rate. Once that foundation is shattered—once Treasuries are repriced—everything else gets repriced.

When Treasury prices fall, yields spike, and borrowing costs explode across every market. Corporate debt, mortgages, equities, commercial real estate, municipal bonds—everything that takes its cue from the risk-free rate resets violently.

Welcome to the multi-sovereign debt crisis

US Treasuries are the benchmark for sovereign debt pricing worldwide. If Treasuries aren’t safe, nothing is. When Treasuries collapse, the global sovereign bond market follows. Risk-free assets cease to exist. One by one, governments default, and no central bank can stop it.

The first to fall would be the developed economies most reliant on Treasuries.

- Japan goes first – With over $1 trillion in US debt holdings and a banking system already weighed down by ultra-low interest rates, a Treasury collapse hammers Japanese Government Bonds (JGBs), sending Japan’s financial sector into crisis.

- The Eurozone follows – The European Central Bank (ECB) has been artificially supporting weaker economies like Italy, Greece, and Spain. Without the stabilizing presence of Treasuries, bond spreads widen violently, and the Eurozone debt market unravels.

- The UK isn’t far behind – The 2022 Gilt crisis exposed just how fragile UK debt markets are. A Treasury default would send UK pension funds and financial institutions into freefall.

But the fallout doesn’t stop there.

- China faces capital flight—but where does it even go? There is a liquidity crisis and banking instability as $800 billion in Treasuries lose value overnight. More critically, China’s currency stability is partially pegged to the US bond market. If Treasuries collapse, the yuan enters wild volatility.

- India, though less directly exposed, is deeply tied to the global financial system. A Treasury collapse would ripple through India’s corporate and banking sectors, leading to credit shortages and market turmoil.

- Emerging markets—many of which hold their reserves in Treasuries—would be devastated. Global capital would flee, triggering currency collapses, inflation spikes, and sovereign defaults across the developing world.

Where this spirals, no one knows. No one knows how this ends because the world has never seen a multi-sovereign debt collapse with no lender of last resort.

We _can _be sure that this would result in a near-global liquidity freeze, mirroring what happened in 2008 after Lehman. This time, there’s no safety net, and this time, it’s global. Withdrawals stop. Payments stall. Banks stop lending, markets freeze, and governments default. The circulatory system of the global economy collapses—and everything with it.

Crushing collateral crunch

The overwhelming majority of financial transactions are bilateral—agreements made directly between counterparties. Because there’s always a risk that a counterparty might default, collateral is pledged to reduce the risk of loss and ensure trust in the transaction. It functions much like a mortgage: when you take out a home loan, the bank holds your house as collateral and can seize it if you fail to pay. In financial markets, counterparties do the same—if one party defaults, the other can seize the pledged collateral to cover losses.

US Treasuries are the preferred form of collateral because they are considered risk-free, highly liquid, and universally accepted. Banks, hedge funds, and corporations use them to back everything from derivatives trades to short-term borrowing in repo markets. The efficiency of the global financial system depends on the assumption that Treasuries will always hold their value.

Treasuries are so widely used that they have been rehypothecated—a process where the same collateral is pledged multiple times across different transactions. When a bank or financial institution receives Treasuries as collateral from a counterparty, it can reuse those same securities to secure its own borrowing or obligations. This creates a multiplier effect, where a single Treasury bond supports multiple layers of financial activity. It’s how an outstanding stock of ~$30 trillion in US Treasuries underpins an $800 trillion notional derivatives market.

In the event of a default, Treasuries would plummet in value, forcing firms to either post more collateral or unwind positions. This is where rehypothecation magnifies the crisis—since the same Treasuries are pledged multiple times across transactions, a single drop in value ripples through the system, triggering cascading margin calls, forced liquidations, and a self-reinforcing liquidity collapse.

But as we mentioned above, a US default drives a repricing of all sovereign debt and a multi-sovereign debt crisis. This could lead to a scenario that might make repledging functionally impossible. Normally, financial institutions can reuse pledged collateral to facilitate liquidity, but if Treasuries and other government bonds are all being repriced at the same time, no one will accept them at face value. The entire market for repledging collateral could freeze overnight, grinding the repo market and other secured lending markets to a halt.

And because Treasuries aren’t the only collateral, the crisis spreads. Corporate bonds, mortgage-backed securities, and equities all reprice violently. The secured lending system collapses.

No Insurance for this risk

Just like banks, insurance companies worldwide have undergone reform since 2008 to improve their financial stability. Regulations such as Solvency II in Europe and risk-based capital (RBC) requirements in the US require insurers to hold high-quality liquid assets (HQLA) to ensure they can meet policyholder claims, even during financial stress.

At the core of these reserves? You guessed it—US Treasuries!

And just like banks, insurance companies would face an immediate crisis if the US defaults. A plunge in Treasury values would erode their reserves, forcing them to either raise capital, sell assets, or cut benefits to remain solvent. Worse, because insurers hold Treasuries to back long-term policies, they are less able to absorb short-term market shocks. A widespread selloff could force premature asset liquidations, locking in losses and further destabilizing the financial sector.

At scale, this would create a secondary shockwave beyond the banking system.

Remember, insurance companies—yes, even Berkshire Hathaway (that Berkshire Hathaway)—are among the largest institutional investors, holding massive positions in corporate bonds, real estate, and mortgage-backed securities. If they are forced to dump assets to shore up their balance sheets, it would trigger another fire-sale spiral, worsening the broader financial crisis.

A global insurance collapse wouldn’t just hit Wall Street—it would wipe out pensions, annuities, and everyday policyholders, making it harder for businesses and individuals to recover from financial catastrophe. In a worst-case scenario, insurance failures could leave millions without coverage—right when they need it most.

Whither Bitcoin?

For years, cryptoenthusiasts have insisted that Bitcoin would be the ultimate safe haven in a financial system collapse.

Really?

Bitcoin’s value isn’t intrinsic—it only exists because you can exchange it for fiat. If liquidity dries up (as described above), there’s no cash to move into or out of Bitcoin. And that’s before you even consider the practical impossibility of transacting when the global banking system is offline.

But that’s not even the funniest problem. Bitcoin doesn’t just need the global financial infrastructure to facilitate transactions—it needs the financial system to keep the money flowing to the people keeping Bitcoin alive.

Remember, Bitcoin isn’t some magical currency, conceived in Liberty, and fueled by the sheer power of pseudoanonymity. The entire scheme depends on an insanely energy-intensive network of mining rigs—a network that devours ~170 terawatt-hours (TWh) annually, more electricity than Poland or the Netherlands. A network that, like everything else, only runs if the bills get paid.

So if the financial system implodes, who’s paying the miners? Who’s covering the energy costs? Who’s maintaining the hardware?

And that leads to an even stranger set of problems. Let’s say miners start shutting down because they can’t afford energy, bandwidth, or cloud computing resources. With fewer and fewer miners competing to validate transactions, the network becomes slower and more fragile. If enough miners drop out, what happens to Bitcoin itself?

Would the blockchain survive? If too many miners go offline, could the remaining nodes fall out of sync, fracturing Bitcoin into competing, corrupted ledgers? And if that happens, in a system with no central authority, who gets to decide which version is the right one?

If Trump defaults on Treasuries, Bitcoin (all crypto) doesn’t become a refuge—it becomes collateral damage

Default is a dead-end!

So what happens if the US defaults?

The entire economic system implodes. It triggers a system-wide margin call on everything we’ve known for nearly a hundred years.

The only good news? We'd all be broke together.