Why Europe’s Future Depends on Understanding China

Europe’s Green Transition Begins with Raw Materials

Europe’s relationship with China is no longer a distant geopolitical issue or a debate confined to trade balances and finished goods. It begins much further upstream — with raw materials, which are essential inputs for clean-energy and high-technology manufacturing.

As the European Union accelerates its climate and digital transitions, demand for critical raw materials such as lithium, cobalt, rare earth elements, and silicon is expected to rise sharply. These materials are indispensable for producing solar panels, batteries, wind turbines, electric vehicles, semiconductors, and advanced industrial equipment — the building blocks of modern industry and energy infrastructure. According to the International Energy Agency, China’s share of global polysilicon, ingot and wafer production will soon reach almost 95%.

In 2024, China supplied approximately 46.7% of the EU’s lithium oxide and hydroxide imports by volume, but 57.5% by value, highlighting China’s dominance in higher-grade processed lithium chemicals. Lithium hydroxide is important because it is needed to make high-performance batteries that store more energy and give electric vehicles a longer driving range.

This challenge is reflected in the European Critical Raw Materials Act (CRM Act), legislation designed to secure a sustainable and diversified supply of critical raw materials so that Europe can meet its climate and competitiveness objectives. The Act itself notes that Europe currently relies heavily on imports from third countries for critical raw materials, making supply chains vulnerable without strategic action.

A piece from the European Council highlights that for certain raw materials this reliance is especially acute: China supplies 100 % of the EU’s heavy rare earth elements, materials used in permanent magnets for wind turbines, electric motors, and advanced electronics

Raw materials are not abstract inputs. They are the starting point for every modern industrial value chain — from miners and refiners, to processors and component makers — before finished systems are ever assembled.

Pat McCarthy and ISI delegation visiting smart manufacturing sites in Baoji, Shaanxi, July 2025.

From Raw Materials to Finished Goods: China’s Embedded Role

This upstream dependence flows directly into Europe’s manufacturing and energy systems. Statistics from Eurostat state that China is now the European Union’s largest source of imports, accounting for roughly 21% of all goods imported into the EU. What matters most is not just the volume, but the composition of that trade. In 2024, manufactured goods accounted for approximately 96.7% of all EU imports from China, meaning Europe is overwhelmingly importing industrial products rather than basic commodities.

This includes:

- Clean-energy equipment such as solar panels and batteries

- Electronics, semiconductors, and circuit boards

- Machinery, tooling, automation equipment, and industrial components

These are not optional consumer goods. They are inputs into Europe’s energy infrastructure and manufacturing base.

Clean Energy and China Structural Reliance

Europe’s dependence on China is especially visible in clean energy. Analysis by the International Energy Agency shows that China controls over 80% of the global solar photovoltaic manufacturing value chain, from polysilicon processing through to finished modules, as detailed in the IEA’s report on solar PV global supply chains.

Within the EU, this dominance translates into near-total import reliance. Reporting by Reuters highlights that around 95–98% of solar panels installed in Europe are sourced from China, following the collapse of much of Europe’s domestic solar manufacturing industry in the early 2010s, as described in Reuters’ coverage of EU solar procurement.

According to SolarPower Europe’s EU Solar Market Outlook 2025-2030 (December 2025), utility-scale solar became the dominant segment in EU installations for the first time in 2025. Solar panels are not consumer goods in this context; they are capital inputs installed in power plants to generate electricity for factories, transport systems, and households. In this sense, Chinese-manufactured equipment helps power the very systems that underpin European industry.

Europe’s Manufacturing Dependence on China

China’s influence extends far beyond solar energy. European manufacturing relies heavily on Chinese inputs across sectors such as electronics, batteries, machinery, tooling, and industrial equipment.

In 2024, the European Union imported around $173.7 billion worth of electrical and electronic equipment from China, making China a major supplier of electronic components used in European technology, industrial automation, and consumer goods, according to EU import data on electrical and electronic equipment from China.

China also produces more than 50% of the world’s printed circuit boards (PCBs), which are essential intermediate components used in products ranging from automotive electronics and industrial controls to telecommunications equipment, as documented in global PCB market analysis by Prismark.

Battery supply is another area of deep integration. A significant share of the batteries imported into the European Union originates in China, underpinning electric vehicles, grid storage, and portable electronics, with China accounting for around 87 % of EU battery imports.

Machinery and industrial equipment — including machine tools, automation systems, and critical replacement parts — represent another major category of Chinese-sourced manufactured goods. In 2024, the EU imported over $100 billion worth of machinery and industrial equipment from China, illustrating the scale of China’s role in supplying industrial inputs, according to EU machinery and equipment import statistics.

These are not peripheral items. They are central to the functioning and competitiveness of modern manufacturing systems, embedded directly in Europe’s factories, production lines, and industrial infrastructure.

China’s Advantage in Scale, Speed, and Execution

China’s industrial dominance is visible not only in volume, but also in execution. Projects such as the Shanghai Maglev, which reached commercial operating speeds of up to 431 km/h, demonstrate China’s ability to translate advanced engineering into sustained, real-world operational systems, as documented in Maglev Board’s technical overview of the Shanghai Maglev.

This same combination of scale, coordination, and speed underpins China’s leadership in advanced electronics, e-commerce, electric vehicles, clean-energy systems, and emerging sectors such as humanoid robotics.

A Maglev Train departing from Pudong International Airport

A Maglev Train departing from Pudong International Airport

Why This Changes the Skills Europe Needs

Taken together, these supply realities explain why Europe–China literacy is becoming a core professional capability. Europe’s future energy systems, manufacturing base, and economic competitiveness are closely connected to China’s industrial ecosystem. Understanding how China works — its language, culture, institutions, and business practices — is no longer optional for professionals in trade, technology, energy, logistics, diplomacy, politics, or international cooperation.

This is a matter of capability and resilience, not ideology.

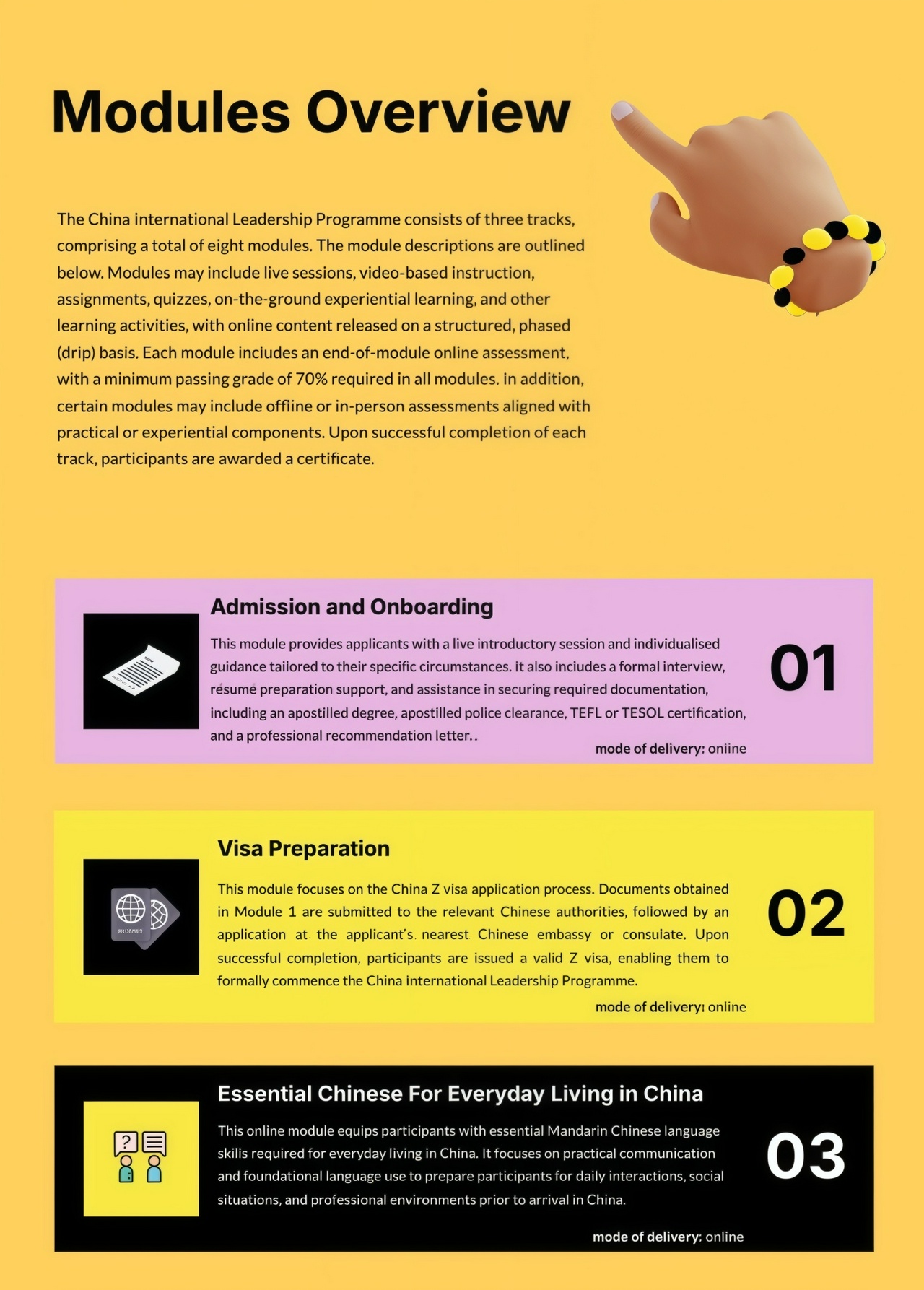

A Practical Response: The China International Leadership Programme

The China International Leadership Programme (CILP) was created in response to this reality. Its most advanced pathway — the Ambassador for Europe–China Relations Track — is designed to develop individuals who can engage China with confidence, credibility, and real-world understanding.

The programme follows a blended model, combining structured online learning with extended immersion in China.

Core programme components include:

- Mandarin language immersion (HSK-aligned)

- Chinese cultural immersion

- Factory and smart-manufacturing site visits

- Guided exploration of iconic sites and key regions

- Leadership development through teaching and community engagement

Mandarin training is HSK-aligned, ensuring language learning is structured, measurable, and internationally recognised. Cultural immersion and industrial site visits give participants first-hand exposure to how Chinese institutions, companies, and communities operate.

Leadership is developed through contribution, particularly through teaching practice and mentoring in community settings — building adaptability, empathy, responsibility, and cross-cultural communication skills.

Preparing for a China-Connected Europe

As Europe navigates decarbonisation, technological change, and global competition, demand will continue to grow for people who understand China from the inside. The Ambassador for Europe–China Relations Track prepares participants for that future by combining language capability, cultural immersion, industrial insight, and leadership developed through real contribution.

This programme is not simply an international experience. It is strategic preparation for a world in which Europe’s energy systems, manufacturing base, and economic resilience remain closely connected to China.

The programme is coordinated by the Ireland Sino Institute, an organisation dedicated to strengthening Europe–China relations through education, business, philanthropy, culture, tourism, and technology.

China International Leadership Programme Overview

Sources

https://www.iea.org/reports/solar-pv-global-supply-chains/executive-summary

https://www.consilium.europa.eu/en/infographics/critical-raw-materials/

https://www.iea.org/reports/solar-pv-global-supply-chains/executive-summary

https://www.solarpowereurope.org/insights/outlooks/eu-solar-market-outlook-2025-2030/detail

https://arxiv.org/abs/2501.01781

https://tradingeconomics.com/european-union/imports/china/electrical-electronic-equipment

https://www.acea.auto/files/ACEA_Fact_sheet-EU_battery_supply_chain_and_import_reliance_.pdf

https://tradingeconomics.com/european-union/imports/china/machinery-nuclear-reactors-boilers

https://www.maglevboard.net/en/facts/26-transrapid-maglev-shanghai

https://irelandchinainstitute.eu/

https://payhip.com/AllThingsChina

© 2025 Europe China Monitor News Team