Live by the Code… Die by the Code?

It's an exciting time to be alive. In last year's TechLawFest, Singapore's signature legal conference for folks who need to shore up their tech gravitas, NFTs were discussed furiously. Back then, NFTs were the hottest thing in the universe, and lawyers either knew NFTs or didn't.

The world is much different these days. TechLawFest has already moved on to the “Metaverse”.

We've got more top-notch speakers to break down every aspect of the Metaverse for you.

Don't miss out: https://t.co/BvgY2wOqpy #futurelaw #lawandtechnology #tlf #tlf22 #techlaw #techlawfest pic.twitter.com/c6OMnx5f3Q

— TechLaw.Fest (@TechLawFest) May 24, 2022

In the meantime, the value of NFTs and cryptocurrencies plunged. Two years of financial gains were wiped out. Suddenly, celebrities piping cryptocurrencies went quiet and were ordered to do some soul searching.

It's the biggest “I told you so” moment in my recent memory. This makes the websites of crypto sceptics fun to read. The “counter” memes are fun too.

Diamond Hands is crypto slang, by the way.

Diamond Hands is crypto slang, by the way.

Anyone familiar with the reality in this space is well aware that scams and frauds are plentiful, and the dreams are as beautiful as the chasms you can fall into. This isn't an investment blog, but high risk doesn't lead to high returns. A get-rich scheme is not for the faint-hearted or the ethically firm.

From the Boulevard of Broken Dreams

I am secretly happy that cryptocurrencies and NFTs have finally had their long-coming reckoning. It's not because I like people losing money. Or that crypto bros will finally shut the hell up.

My interest in this area is quite intellectual. I think such technologies raise fascinating questions, which is the most lawyerly thing you will hear me say on this blog for a long time.

Take stolen NFTs, for example:

Looking forward to precedent setting debates on IP ownership & exploitation, having spent 18 years studying copyright & the industry laws. I’d ather meet @DarkWing84 to make a deal, vs in court. We can prove the promise of ape community https://t.co/U1GpYK2X7d

— Seth Green (@SethGreen) May 24, 2022

You might remember Mr Green as either Dr Evil's son, a voice on Family Guy, or the creator, writer, etc., of Robot Chicken. He was also a victim of a phishing scam which took away his NFT. All this sounds rather ordinary, but Mr Green also had plans to use the Ape referred to in his NFT for a show. Without his NFT, he can't make his show.

Sorry, what?

Presumably, it's because when you own an NFT, you own the right to parade it in other material. You know, like how some people pick which shows their pets will star in. If you don't own a pet, there's no show.

However, it's not so simple. An NFT is a reference to a particular bunch of data on a blockchain. Furthermore, “owning” a thing isn't necessarily the same as owning its intellectual property. No one gets the idea that because they bought a Harry Potter book, they get to start their own Harry Potter universe.

Even so, this confusion is particularly rife with digital products. Just because you own the “metaverse” handle on Instagram doesn't take away Meta's right to take back their handle per their terms of use.

Beware the metaverse. It's not all fun and games out there.

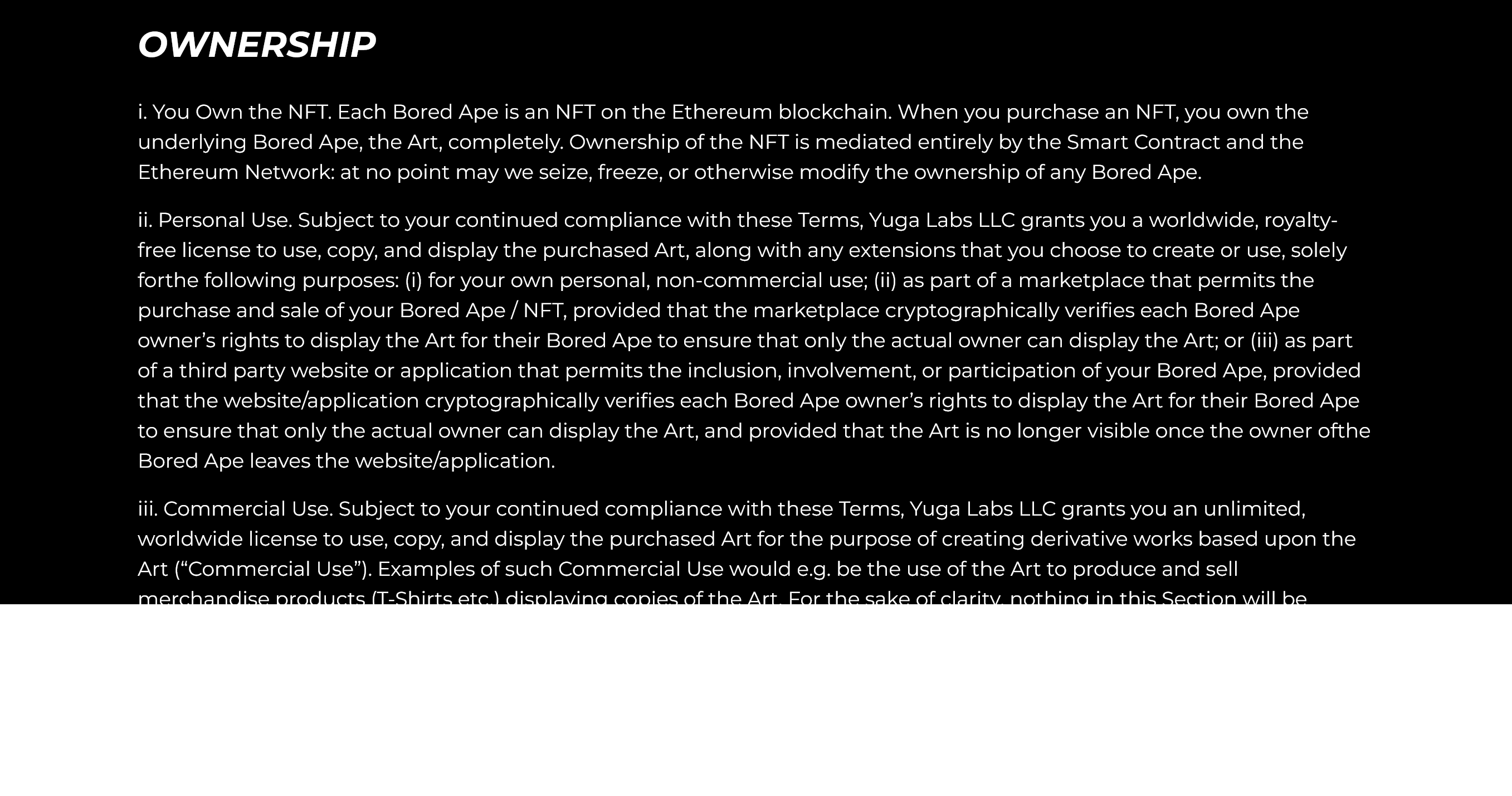

In this regard, BAYC's terms of use are a crap shoot.

Source: https://boredapeyachtclub.com/#/terms (access 12 June 2022)

Source: https://boredapeyachtclub.com/#/terms (access 12 June 2022)

- Yes, “You Own the NFT”. That sounds great, even though the capitalised “Own” looks fishy.

- “When you purchase an NFT, you own the underlying Bored Ape, the Art, completely”. What's with the comma between “Bored Ape” and “the Art”? Is “Bored Ape” the definition of the “Art”? Or are there two things, the “Bored Ape” and “the Art”? What does owning something “completely” mean anyway?

- Clause ii starts with “Subject to your continued compliance with these Terms…”. I guess this is what owning something completely means?

- Who is “you” anyway?

Of course, this may be only a snapshot of the agreement between BAYC and the owner of NFT. Other terms like the smart contract or at OpenSea may apply. However, with terms this grossly vague, it's hard to expect the other conditions to be an improvement or fully resolve all arguments. You'd expect any lawyer with a bit of imagination to have a field day with this.

This is perhaps why Mr Green would love to make a deal rather than meet the current owner of his phished NFTs in court.

The issues with stolen NFTs aren’t so novel

Regarding the issue of who “owns” a stolen NFT, you may be surprised that there are precedents. In fact, this problem is so well known that it forms a key part of a first-year contract law student’s learning.

The theory, distilled, is as follows. The original owner didn’t intend to transfer his NFT to a fraudster. There was a mistake that voided his consent to the (smart) contract that operated the transfer. If such a contract is voided, the fraudster had no right to transfer his NFT to his unwitting buyer. The unwitting buyer thus doesn’t own the NFT. The court will order the buyer to transfer the NFT back to the original owner.

We would be short-changing the law students if the issues were so straightforward:

- The unwitting buyer is also a victim because he bought the NFT without knowing it was stolen. It’s a choice between two victims — either take the NFT from the unwitting buyer or leave the original owner out.

- What kind of mistake should void consent? Surely, they have to be really big mistakes, right?

- Is the buyer really a victim? The cost of an NFT is fairly well known. Can one buy an NFT at such a low price that he or she has to know it is part of a criminal enterprise?

It’s even more surprising that you don’t have to travel out of a web3 world to find an example. In Quoine Pte Ltd v B2C2 Ltd [2020] SGCA(I) 2, computers were made to trade Ethereum and Bitcoin at superfast speeds and without human intervention. The code led to unexpected results such that USD285 million in Bitcoin (back then) were contested between two market participants. Was the bug a mistake that allowed one participant to cancel the contracts? The majority of the court said no. The code was doing what everyone intended.

If this was the case, how is hitting the transfer button a mistake? In a decentralized and “trustless” world, a buyer isn’t expecting the identity of a seller to be a material issue in a transaction. Aren’t you supposed to be taking good care of your account yourself anyway? The system is working as expected.

“Working as expected” is the kind of phrase you throw around when you are feeling unkind. Quoine’s dissent is also interesting, and I reproduced it here:

There is nothing surprising, impermissible or unworkable therefore about a test which asks what any reasonable trader would have thought, given knowledge of the particular circumstances.

Three Things: Our Robots made our mistake worseThe plot sounds like something from right out of a movie. In the dead of the night, computers have been doing their thing — buying and selling cryptocurrencies based on maths and science. One morning, a human checks in and realises that something has gone very wrong. A glitch in the algorithm caused…Love.Law.Robots.

In Blog version 2020, I wrote about this case.

In Blog version 2020, I wrote about this case.

A reasonable trader, or a reasonable market participant, isn’t an ordinary guy. He represents the best of us, the fairest of us and the guy we need to be when we are tempted by greed, hubris and selfishness.

In a world replete with scams and grifters, perhaps a reasonable person is what cryptocurrency needs.

The building blocks of a major lawsuit are in place

Photo by Hello I'm Nik / Unsplash

In other news, a law firm in Singapore managed to secure a worldwide freezing order over an NFT in a purely commercial dispute (a botched loan agreement). There aren’t any details on how such an order will be enforced — would they serve it on an online marketplace and force them not to process any transactions? In any case, the fact that it succeeded will tempt others to try it themselves.

The more people look to the legal system to enforce what they perceive as their rights, the more opportunities courts will have to comment on them. The outcome might not be what early adopters prefer or expect — a court can hold that it isn’t reasonable to claim that a phished NFT belongs to an unwitting buyer because the code of the smart contract worked as expected. Similarly, cryptocurrency is as decentralised as finding a marketplace which wouldn’t obey court orders.

The key here is that there must be people who value their NFTs enough to request a court to protect their rights. In a bull run, the incentive to do so is muted because it would probably be more profitable to continue investing. In a bear market, when the chips have fallen, promises that have been made must be kept. And that’s when the lawyers come in.

Hopefully at some point, we’d clear the deck of grifters and scam artists, and leave cryptocurrency, NFTs and even maybe the Metaverse with the norms of a sustainable enterprise.

That’s what everyone wants, right?

#tech #TechLawFest #TechnologyLaw #Cryptocurrency #NFT #Contracts #Law #News

Love.Law.Robots. – A blog by Ang Hou Fu

- Discuss... this Post

- If you found this post useful, or like my work, a tip is always appreciated:

- Follow [this blog on the Fediverse]()

- Contact me: