VCs Are Betting on AI in the Construction Tech

October 29, 2025

Let me share what I've learned from analyzing 1,330 Private Equity deals over the last 12 months (ending June 2025), totaling $90.3 billion in the Construction & Engineering space.

The Money Is Real – And It's Massive

Here's the headline: AI-focused construction startups are raising 3.2x more capital per round than traditional construction tech companies. That's not a typo. In Q2 2025 alone, we saw $3.96 billion flow into construction tech, with 68% going to AI-enabled solutions.

This isn't just Silicon Valley hype. The construction industry is a $13 trillion global market that's been stuck with 1% annual productivity growth for two decades while the rest of the economy grows at 2.8%. VCs finally understand that whoever cracks this problem will capture enormous value.

The Big Players Are All In

What really caught my attention is who's writing checks. We're seeing three distinct investor types:

Tier 1 Tech Funds like Khosla Ventures, General Catalyst, and Insight Partners are leading platform plays with $15-50M checks. They're not interested in point solutions—they want companies that can transform entire workflows.

Construction Specialists like Brick & Mortar Ventures and Fifth Wall bring deep industry knowledge and are writing $5-20M checks. These folks understand the real pain points because they've lived them.

Corporate VCs from Cemex, Caterpillar, and Autodesk are strategically investing $3-15M in companies that align with their product roadmaps. They offer something money can't buy: customer validation and distribution.

Five Technologies Dominating Investment

After analyzing all these deals, five technology clusters are capturing 87% of the capital:

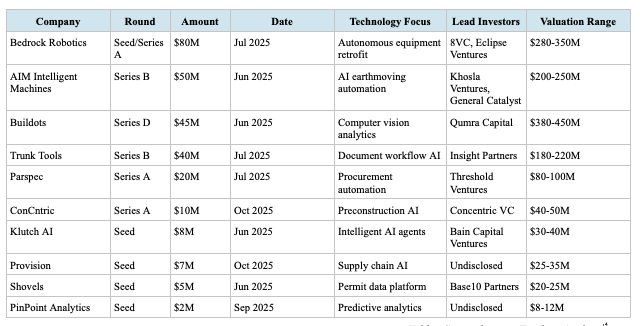

Autonomous equipment – Bedrock Robotics just raised $80M for retrofitting existing machinery

Predictive analytics – Using AI to prevent delays and cost overruns

Workflow automation – Trunk Tools raised $40M automating document workflows

Computer vision – Buildots raised $45M for site progress tracking

Supply chain optimization – Finally solving the materials and logistics nightmare

What This Means for Seamview

The market is moving exactly where we predicted. The top 20 funded companies represent 74% of total investment – investors want comprehensive platforms, not features. They want the “Bloomberg Terminal for Construction” that we're building.

The shift to Series B and later-stage rounds (now 72% of capital deployed) shows the market is maturing. Early experiments are over. VCs want companies with proven product-market fit that can scale.

Geographic concentration is real – 68% of funding goes to US companies, 14% to Israel. But the opportunity is global, especially in markets like South Africa, where we have deep roots.

The Inflection Point Is Now

We're at a critical moment. The construction industry, unchanged in many ways for decades, is about to transform. The convergence of AI, cloud computing, and industry readiness has created perfect conditions.

The sovereign wealth funds are starting to pay attention – Mubadala, PIF, and Temasek are writing $20-100M checks because they see construction tech as critical infrastructure for national development.

My Take

Having worked on billion-dollar construction projects — from TSMC fabs to the Riyadh Metro —I've seen every pain point this industry has to offer. The VCs are finally understanding what we've known all along: construction isn't just ripe for disruption – it's desperate for it.

The winners won't be those building clever features. They'll be platforms that understand construction's fundamental challenge: organizing massive flows of information, money, and materials in accordance with contractual obligations. That's why we built SeamCodes at Seamview – to create a universal language for construction data, just like Bloomberg created for financial markets.

The $8.7 billion flowing into our space isn't just investment – it's validation. The industry that built the world is finally getting the technology it deserves.

And we're just getting started.