The 5 years that changed my life

Each day I start with a prayer with my dog Autie- Shema Yisrael (שְׁמַע יִשְׂרָאֵל) “Hear, O Israel: G‑d is our L‑rd, G‑d is one.”

The 5 years that changed my life

There was a point in my life where I shut myself in a room for 20 hours a day for a couple of years. Except for feeding cows and fencing I sat in a small room, stared at white boards filled with notes and read books. I studied and focused on the financial markets learning how to make good investment decisions. Something that had eluded me most of my adult life. I had entrepreneurial successes but seemed incapable of sustaining them and building real wealth.

First I was fortunate I could take time off life leave my job. If I had a family or traditional career it would not have been possible. Secondly I had my faith in the system erased after fighting lawsuits to defend the rights of others and playing journalist.

Third I had a best friend who never gave up supporting me. Even when I gave up on myself she did not give up on me. The only response I have is to follow my Grandfather's rule of the three little A's. Give them Appreciation, Affection and Attention daily. Do this to who you care about and you won't have to worry about anything. You don't need books, talk shows or therapists. Just be a fucking man.

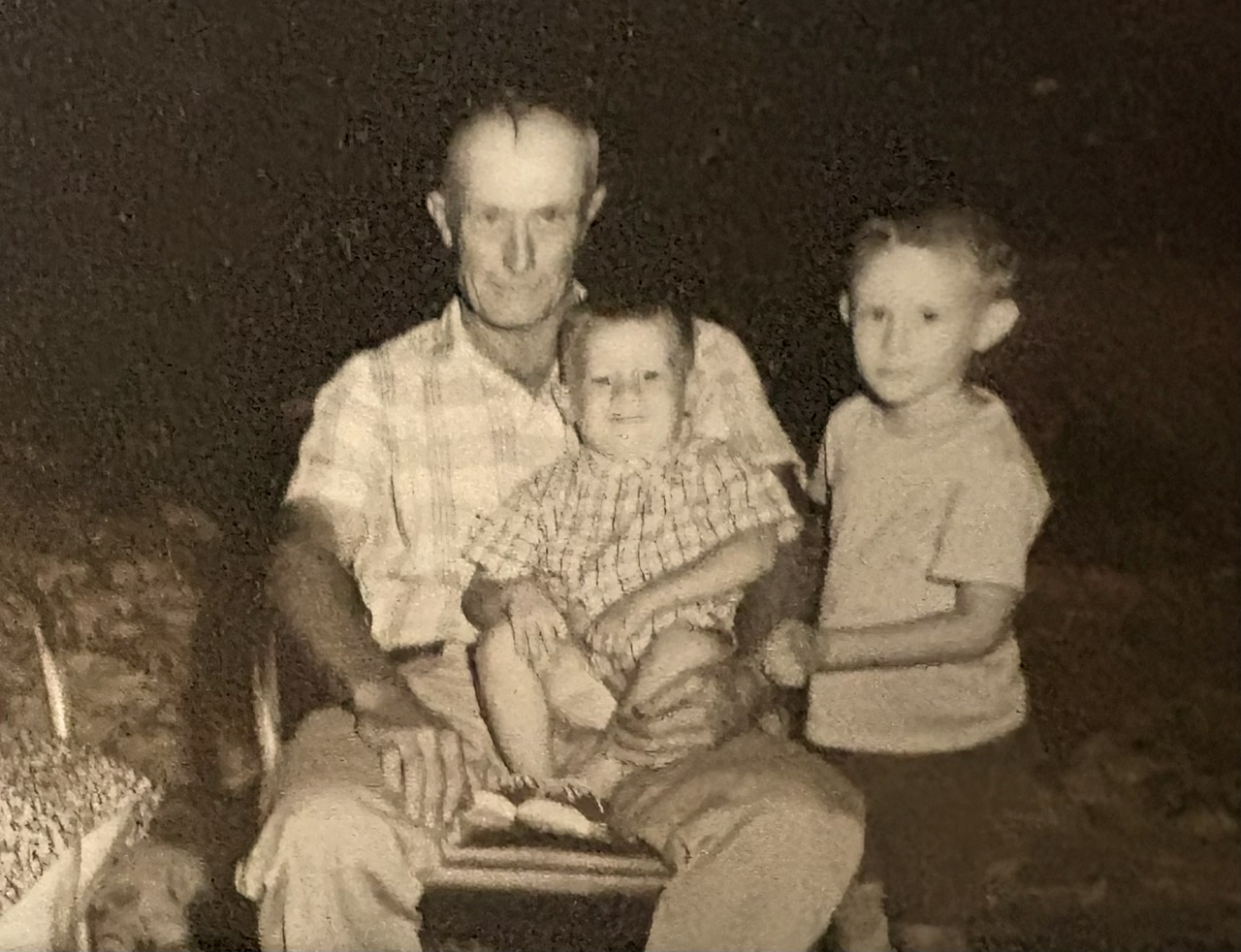

My Grandfather Leroy Carroll

My Grandfather Leroy Carroll

Lastly I had a father that was tough as nails and mean as hell that tried to make life impossible for my mother and me. Sometimes it takes a fierce adversary to make you realize the world does not play nice. Simple rules – destroy those that seek to harm you, show them no mercy. Never give anyone except those you love a second chance.

Was I crazy to think in my late 40’s a man could sit in a small room invest over a year studying what Warren Buffet, Bogle and and Lynch successfully did, learn to identify patterns and find value in what other miss? Can I give myself something better than a college MBA?

In my case, with a great deal of luck, struggle, a 1,000 cups of coffee and psychedelic mushrooms I succeeded while managing herd of 200 cows single handedly.

It was not easy and the hardest part is still not to lose faith when numbers don’t go how you hope but stay the course. The herd goes one way, smart money another.

Laugh if you want to the image of mushrooms and cows but this way of thinking I developed made me millions. It forced me to clearly see the world as it is and not how I wanted it to be. Only then could I make good investment decisions.

I had had chances before in life and was grateful to have worked for Tom McCloskey at Cornerstone Capital But the truth is I wasn’t mature or responsible enough to be there at that point in my life. Nor did I appreciate the opportunity. Suddenly I was capable of serious adulting and what lessons I learned from Tom and his team were my starting point. I realized I had learned a lot more than I ever thought.

A simple philosophy from him guided me – outwork and out-think anyone standing in your way. The painful truth I faced is all this time I was standing in my own way.

My bed was this sleeping bag for several years

My bed was this sleeping bag for several years

Here are the books I studied and invest based on their principles.

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books, Big Profits) 2017 by John C. Bogle

- The Intelligent Investor, 3rd Ed.: The Definitive Book on Value Investing, 2024 by Benjamin Graham, Jason Zweig

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The Worlds

- The Warren Buffett Stock Portfolio: Warren Buffett Stock Picks: Why and When He Is Investing in Them – 2011 by Mary Buffett, David Clark

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive Advantage – Deckle Edge, 2008 Mary Buffett, David Clark

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor – 2016, by Jeremy C. Miller

- The Intelligent Investor's Mistakes: Warren Buffett: 38 Buffett’s Investment Stories, Gain Wisdom, Master Risk and Maximize Profits to Build Enduring Wealth, Balaji Kasal

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The Worlds... – Mary Buffett, David Clark

- Educated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment Trusts 1st Edition by Stephanie Krewson-Kelly, Glenn R. Mueller, Merrie S. Frankel, Calvin Schnure

- Investing Between the Lines – 2023 by Rittenhouse

I read the books and took notes. Then I read them again and took more notes. Then I joined online forums and listened to other's ideas and read their notes. Then I took classes about the books and then read them all again and took more damn notes.

Now I know what to do and when to do it without hesitation.

A few things I’ve learned the hard way. Purge your friends and acquaintances that keep you down. Most of them are where they are in life because they won’t do the hard work to change.

Instead, like I often did, they blame others.

Face yourself with radical honesty and where ever you are weak admit it and work your ass off to be stronger. Don’t make excuses for yourself or anyone around you. Right, wrong or indifferent MOVE FORWARD.

Life comes down to two choices, be a sheep or be the wolf.

The path of the wolf is wanting nothing and needing nothing from anyone. Only then is your mind free, use that freedom wisely.

Pray daily and often then work until you drop.

When someone loves you unconditionally, invest back in them 100 fold.

Love a woman as she is and how God made her.

Understand most people only want what they can get from you, mostly money. Use their predictability to your financial advantage. Play to their emotions and needs and on your end keep it math.

Don’t waste a fucking moment on politics, realize it's transactional. Politicians do what they are paid to do, no more no less. The rest is theatre.

Buy only what makes money and relentlessly focus on how to make your money make money. Your budget should be a percentage of the money your money makes- do this and you will kill the disease of lifestyle creep.

When bad times come along don't be scared, Covid or whatever, when everyone is screaming bloody murder and selling out – buy everything that's undervalued.

Be the motherfucking wolf. Eat the sheep.

POSTED BY JON B CARROLL