Ripple Pulse: Regulatory Clarity

What is Ripple Pulse?

Ripple Pulse is a unique and specialized article series composed by myself, Ken Melendez, housed on the Web-Monetized content platform, Coil.com. Ripple Pulse is in no way affiliated or endorsed by the company and is simply to be viewed as a source of entertainment for relevant news and legitimate information regarding the Ripple ecosystem. Any personal views or speculation contained in this series is strictly my opinion and is not to be taken as financial advice.

Who is Ripple?

Ripple is an enterprise-grade software company valued at $10B, partnering with corporate entities around the globe, improving the antiquated payment system, specifically cross-border settlement. Their mission is based around driving the Internet of Value, where money moves as efficiently as information does today. The company has been in existence since 2012 and has re-branded over the years from OpenCoin, to Ripple Labs, and now to simply Ripple.

Why is this important?

Discovering detailed information about the Ripple ecosystem matters because the company is solving one of the biggest problems in all of global finance, cross-border settlement. As the current settlement system stands, foreign accounts need to be pre-funded with large amounts of capital serving no other purpose than sitting there waiting for a transaction to go through which can take anywhere from 3-5 business days.

Ripple is working WITH central banks and regulators from multiple countries to solve the pain points of tied up capital, stone-age transaction times, and unnecessarily high transaction costs. The company has been hard at work for the past 8 years and shows no signs of slowing down.

Ripple is striving to put a dent in the universe, specifically within the payments realm, different than any other organization in the industry. Institutional and retail investors alike need to pay close attention to any and all developments occurring within the ecosystem to stay on the cutting-edge of this unprecedented phase in history.

**Pulse Highlights:

**

⦿ Davos 2020 Event

⦿ BitPay Announcement

⦿ **Coil Improvements

**

☕️ Dear reader,

The United States is on the brink... The bleeding edge of regulatory clarity. In fact, you could already argue that regulations already exist. Banks such as PNC and Bank of America have been operating under regulation since inception. Financial institutions such as MoneyGram and TransferGo follow their own particular set of regulations. Ripple provides software to these players in the finance industry and plays by the same rules set in place by regulators of each institution.

Ripple sells their tech stack to banks and is under the same regulatory framework as the customers they provide those services to. RippleNet, Ripple's flagship software, has 3 main components, one of them employing the digital asset, XRP. The area where regulation gets a bit tricky is the engagement with a cryptocurrency such as XRP to facilitate cross-border settlement transactions. Currently, there is a Ripple court case in review which will either deem XRP a security or not a security.

The problem with deeming XRP a security is that the XRP Ledger existed before Ripple was a company. Ripple was gifted the 50+ billion XRP to help grow the ecosystem and distribute the digital asset to expand its use cases. In addition, if Ripple closed its doors tomorrow, XRP would continue trading on hundreds of exchanges around the world. Owning XRP does not give the holder stock options in Ripple the company by any means which is what a security is meant to accomplish.

A lot of activity is happening this month including the Davos 2020 event hosted by the World Economic Forum. We will unpack important moments from the event as well as XRP news and community updates. Later on we will dive into recent happenings with Coil and also peer into the future with Xpring investments and the speculative potential of the market in the coming years. If you are a Coil subscriber, be sure to stick around to view the bonus content at the end.

On the Ripple Front

Davos 2020

The World Economic Forum hosts an annual meeting in Davos-Klosters with the world's top leaders. Established in 1971, the WEF is an international organization for public-private cooperation headquartered in Geneva, Switzerland. A multitude of industry leaders from across the globe joined together for an event of epic proportions.

...the foremost creative force for engaging the world's top leaders in collaborative activities to shape the global, regional and industry agendas at the beginning of each year.

The Ripple team was in attendance including CEO, Brad Garlinghouse and Head of Product, Asheesh Birla. Expectations were looming as Christine Lagarde, head of the European Central Bank, was to give a speech centered around the current / future monetary policy changes. XRP holders anxiously awaited Lagarde to verbalize the words Ripple or XRP in her speech. She did not make any mention of those words during her visit to Davos.

Possible Ripple IPO

During the conference, Head of Product at Ripple, Asheesh Birla, Tweeted a quote from CEO Brad Garlinghouse while he was on stage speaking on “Changing the Finance Industry from Within”.

Here is the quote which took the XRP community by surprise...

“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.” @bgarlinghouse

at #WEF20

This single quote has caused quite the stir on Twitter as Ripple supporters went back and forth on the topic. Some believe that it is a natural progression of a company while others see it as a warning sign. Time will tell what will ultimately happen over the next 12-24 months as the company progresses.

Secretary of Treasury Steven Mnuchin

Among the plethora of world leaders in Davos, Steven Mnuchin, Secretary of the US Treasury, was in attendance. When Mnuchin was asked about cryptocurrencies on stage, this was how he responded...

"There are benefits to cross-border payment systems in lowering costs for consumers and businesses. We absolutely support companies working on this."

Then, in Brad's words from his tweet on January 21st, he states the following... “Critical to apply this pragmatism to US regulation.”

The Secretary of Treasury himself says that they absolutely support companies working to lower costs on cross-border payment systems which is what Ripple has been working on for years.

WEF CBDC Policy-Maker Toolkit

The World Economic Forum published a new toolkit, or insight report, focused on Central Bank Digital Currencies, or CBDC's. The purpose of the toolkit is to provide a resource for central banks to decide whether or not they would like to move forward using their own CBDC, weighing the potential benefits with the risks involved.

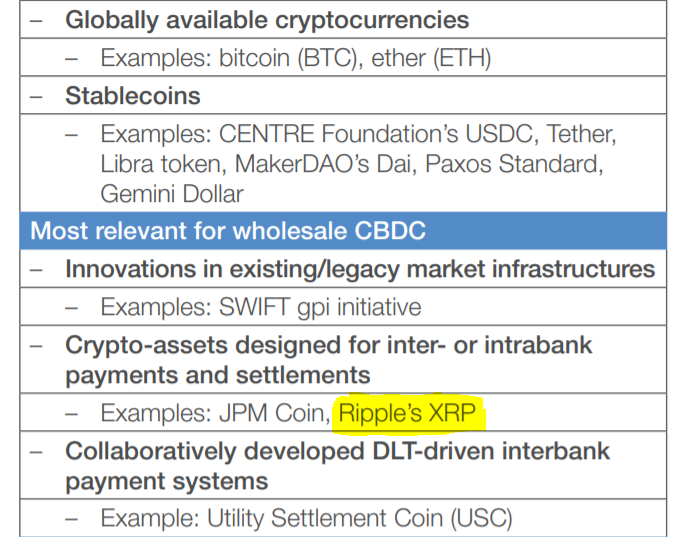

Page 17 of the document (which can be found here http://www3.weforum.org/docs/WEF_CBDC_Policymaker_Toolkit.pdf) addresses the digital payments ecosystem, showing a list of cryptocurrencies available today. The WEF makes specific mention of Ripple and XRP as shown highlighted below.

The fact that such a large, respected entity recognizes Ripple and XRP means that they have done their research and see XRP as a crypto-asset designed for inter-bank payments and settlements.

MoneyGram Partnership

In a recent announcement this month by Times of Oman, a strategic partnership was formed between Ripple partner, MoneyGram, and Lulu Money, a cross-border remittance company located in the Asia-Pacific region focusing on non-banking finance in foreign exchange and global money transfers.

MoneyGram money transfers will now be available though...

an extensive network of Lulu Money branches, liaison offices, and 50,000+ trusted agents.

MoneyGram will be working alongside Lulu Money to help grow their customer base and create new digital products to help grow their reach, expanding financial inclusion to customers in the Asia-Pacific region. Ripple remains in partnership with MoneyGram to help reduce the cost and increase the speed of financial transactions as MoneyGram continues to expand into new regions such as Asia-Pacific.

XRP

XRP is the native digital asset born on the XRP Ledger, a piece of open-source software that serves as a secure database for any and all value transfers. XRP is known as the bridge-asset because of its use in cross-border settlement, exchanging one fiat currency to another in mere seconds.

Price Fluctuation

Despite the news surrounding XRP used in Ripple's product, On-Demand Liquidity, the price of XRP has remained fairly stagnant. Here is a chart showing the last month of price activity. We started at $0.19 on the 24th of December and we now are showing $0.22 as of the time of this article.

As you can see, there were days when the price shot above $0.22 all the way up to $0.24 but then corrected back down. Right now, the markets are still not factoring in utility of each token. Over time, it is expected that the assets with true utility, or real-world use-cases, will rise to the top of the price charts.

BitPay Announcement

BitPay, a leading cryptocurrency service that instantly transforms crypto payments into cash, adds XRP to it's list of accepted cryptocurrencies. Merchants utilizing BitPay can now accept XRP as payment for goods and services. This is great news for the cryptocurrency space because it allows for yet another use-case to add to the list.

The origin of the partnership between BitPay and Xpring, Ripple's open platform for developers, began in October of last year and is now coming to fruition. BitPay’s wallet users are now able to store, use, and send XRP in the BitPay wallet. The integration is a huge step forward towards broad acceptance of crypto payments across the world.

If you go now and update your BitPay app on your iPhone or Android, you will see an option on the home screen to “Start Using XRP Now”. Tap Add XRP Wallet to add it to your wallet collection.

Once the wallet is available, it will need funded with a minimum of 20 XRP sent to it from a separate account. After that it's good to go and can be used for trade.

Quarterly Report

Ripple releases a quarterly XRP transparency report to keep the public in the loop regarding recent activities. This month they released the Q4 report which dives into details on the company's XRP sales, volume, volatility, and escrow. ODL activity is also mentioned in the report.

A few takeaway items are as follows:

1) Programmatic sales have come to a complete halt from $16M the previous quarter down to zero. Not to mention, OTC, or institutional direct sales, have witnessed an extreme decrease from $50M to $13M which is used to strategically help grow the XRP ecosystem.

2) Escrow activity: Ripple returned a full 1B XRP back into escrow during a particular month of the quarter. In total, the company returned 2.7B XRP back into escrow to use at a later date.

3) ODL Volume: On-Demand Liquidity transactions increased by 290% in Q4 compared to Q3. The number here is astounding as it proves how valuable and how in-demand digital assets, specifically XRP, is today to facilitate cross-border transactions.

View the full report here.

In the Community

XRP Arcade

Leonidas Hadjiloizou runs a site called xrparcade.com which is a one-stop-shop for all-things XRP. News, stats, markets, Ripple, the community, the list goes on. XRParcade is especially good for those who want to learn for the first time or to expand their existing knowledge of Ripple and XRP. Leonidas is continually adding new items to the site every day.

In fact, at the beginning of this year, Leonidas published the 2019 XRP Yearly Report. The report is an absolute monster in terms of depth and detail which had to have taken hours upon hours to compile together. If you want to see the best walk-through of everything that happened last year in the Ripple/XRP ecosystem all in one place, go here to view the report.

Hats off to Leonidas for doing an amazing job on that website. Also, if you would like to support him further, he has a Patreon group that he has put together for fans of his work. This group allows Leonidas to continue the work that he does day in and day out for the community.

Digital Asset Insiders

A few prominent members of the XRP community decided to join forces last month and start their own Patreon group. Mr. B XRP, Digital Asset Investor, and Brad Kimes all traveled to events together last year and wanted to create something special. The entire goal behind the group was to give the community more access to them while also getting neat perks such as exclusive live interviews and ad-free videos.

Even though the initial announcement of the group was misconstrued by many community members and caused a lot of controversy, Digital Asset Insiders remains a success. No one in the group has “insider information”, but was simply the name that was chosen for the group. Mr. B, DAI, and Brad Kimes all are providing members with quality perks and resources to help them along their digital asset journeys.

The group is completely optional as the content creators still do their free videos on YouTube each day. For more information, go to digitalassetinsiders.com.

One More Home

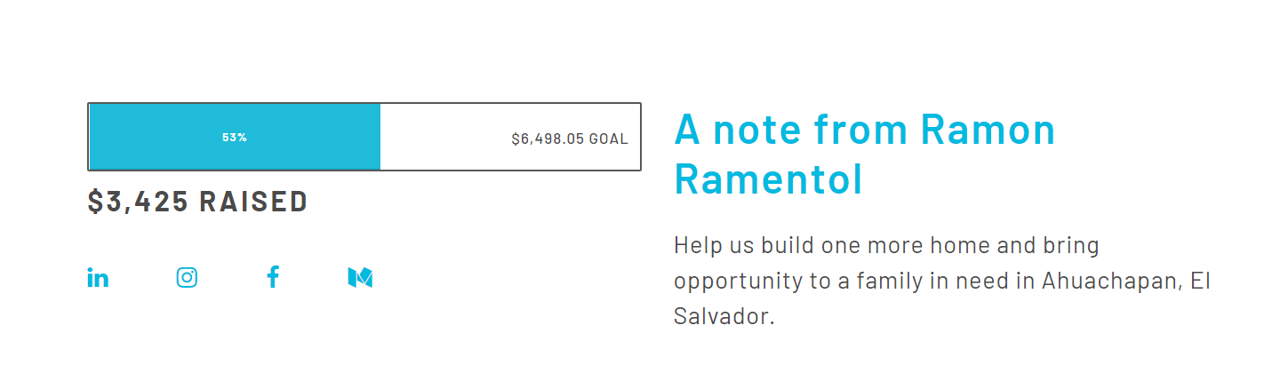

One More Home is a campaign through New Story Charity led by Ramon Ramentol, an XRP community member. The campaign provides homes for families in El Salvador who are in desperate need. The work that Ramon does in writing articles on Coil.com is to support this campaign.

As of right now, the campaign is about half-way funded and is still looking for supporters both inside and outside the community. XRP community members such as Patty B, Nordic Ann, Teena Hall, NixerFFM, and many others are doing what they can to help and to spread the word.

The One More Home initiative gives XRP a use-case that is unique, creating an avenue to give to charity though XRP donations. Ramon is passionate about the campaign as he wants to help provide as many homes as he can to the people of El Salvador. Reach out to Ramon with any questions you may have regarding this charity.

Coil

Site update

Last month, Coil.com announced a new update to their website. The update expanded more on what Coil provides both to content creators as well as content consumers. The fresh look is more appealing and helps up and coming users get a better feel of the platform before they jump head first and sign up. Continual improvements to Coil helps to grow the Web Monetization movement that is taking place as we speak.

Content Creators

Many quality content creators exist on Coil while more continue to pile in each day. The following creators have been doing a great job and deserve to be recognized.

XRP the Standard Productions

XRP the Standard Productions is absolutely knocking it out of the park. Specializing in satire, this creator is extremely talented at taking news stories and putting hilarious twists on them. Each article released is well-thought-out and their page has reached over 170 followers in a short amount of time. One minute the Ripple team is setting sail to Davos, the next minute the lawsuit is on Judge Judy. Go here to view the content.

Kass

Kassjan Smyczek, aka Kass, is an artist through and through. His work is absolutely breathtaking as each piece is carefully orchestrated in either digital art or traditional painting styles. Kass likes to live in the moment and is motivated by the creation process. When he is inspired to create, he takes action and doesn't look back. To view a full gallery of Kass' work, go here and be amazed.

Closing Remarks

So where does this all end up? Where do we stand on regulatory clarity regarding digital assets? It is evident that these technologies are being talked about at an institutional level. No longer is the crypto space being regarded as a place for criminals and drug dealers. Instead, it is now being viewed as the potential rails for the global financial system to run on. It is now being seen as the standard by which banks and financial institutions will build upon from here on out.

If you have been wondering about regulatory clarity, the evidence provided in this article should clear up any concerns you may have. Between the IPO coming in the future, and the Secretary of Treasury claiming to support companies solving real-world, cross-border payment problems, the proof is in the pudding. ✦

Related articles you may find interesting...

First Non-Correlated Asset Class in 4 Centuries

Ripple Sets the Example for Retail Investors

Patreon vs. Coil – Which is Better?

Find out what the future looks like moving into the new decade. Warning: Extremely bullish sentiment ahead...

Continue reading with a Coil membership.